Inflation Worries - German Hyperinflation and 50 Milliarden Mark Stamps

Since 2021, the word "inflation" has become a topic of conversations, opinions and forecasts in the US, Europe and other countries.

Since 2021, the word "inflation" has become a topic of conversations, opinions and forecasts in the US, Europe and other countries.

And so, questions by my sons and grandchildren about the German hyperinflation made me look for our German stamp collection from that time.

My grandfather, and my father as a young boy, had put it together in the early 1920s. Some of the numbers on those stamps truly boggle your mind.

The US Experience

Let's first look at what's happening here. For the younger generation in the US, “inflation” is a term that they know. But they have started only recently to experience its effects themselves.

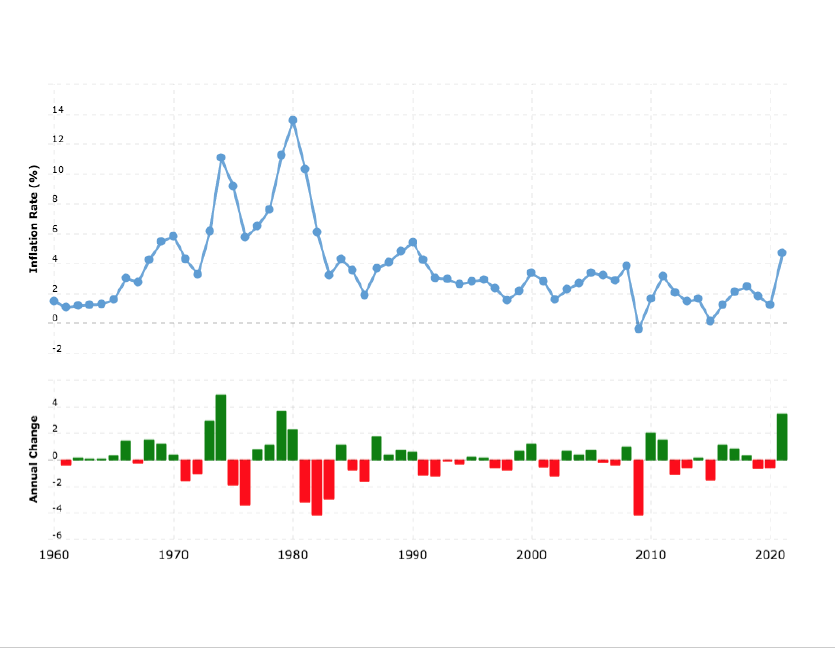

We've all now noticed that many goods have become more expensive over a short time. Indeed, only after 2020 did the US annual inflation rate move above the 5%, something we had seen in the seventies and eighties and then again, briefly, in 2008.

The chart below shows the spike around 1980, which was close to 14%, and then the more recent jump in 2020.

Source:https://www.macrotrends.net/countries/USA/united-states/inflation-rate-cpi

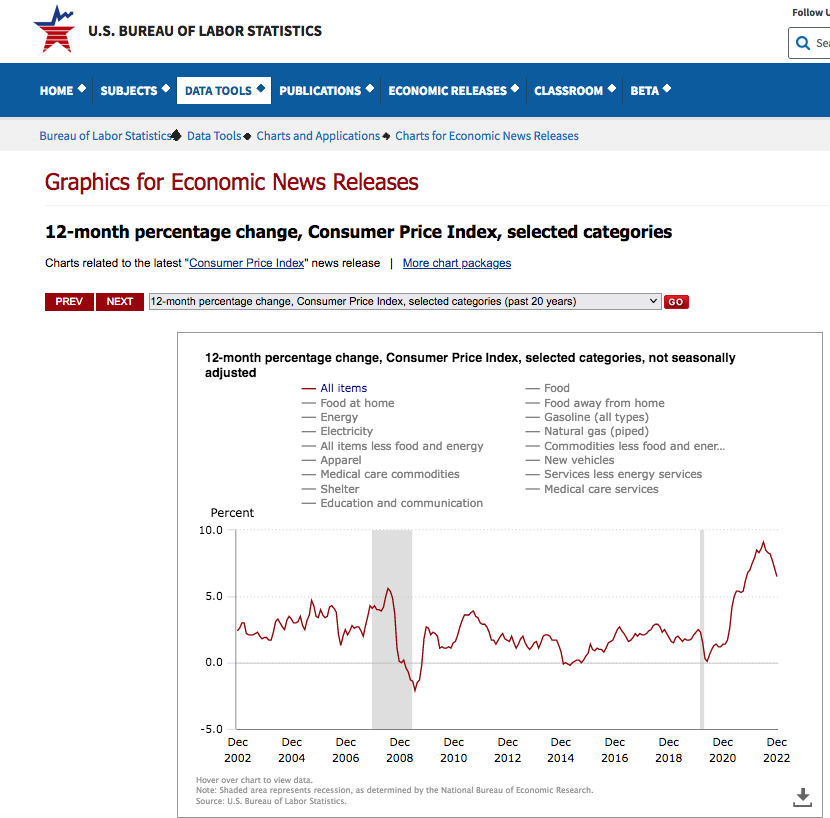

The Chart below shows the 12 month Change of the Consumer Price index for selected categories for the last 20 years by the US Bureau of Labor Statistics (Note also the spike and decline after the “Great Recession” 2007/8)

(After spiking to 9.1% in June 2022, the annual inflation rate for the United States has leveled off to 6.5% for the 12 months ended December 2022, according to U.S. Labor Department data published Jan. 12, 2023.)

The fear of inflation had some worried last year that the US might follow other countries with double-digit inflation rates. Or that the US might even head towards a so-called “hyperinflation”, which Germany experienced during the early 1920s.

These fears were and still are clearly unwarranted, especially when one understands the specific reasons that caused the German hyperinflation.

German Hyperinflation

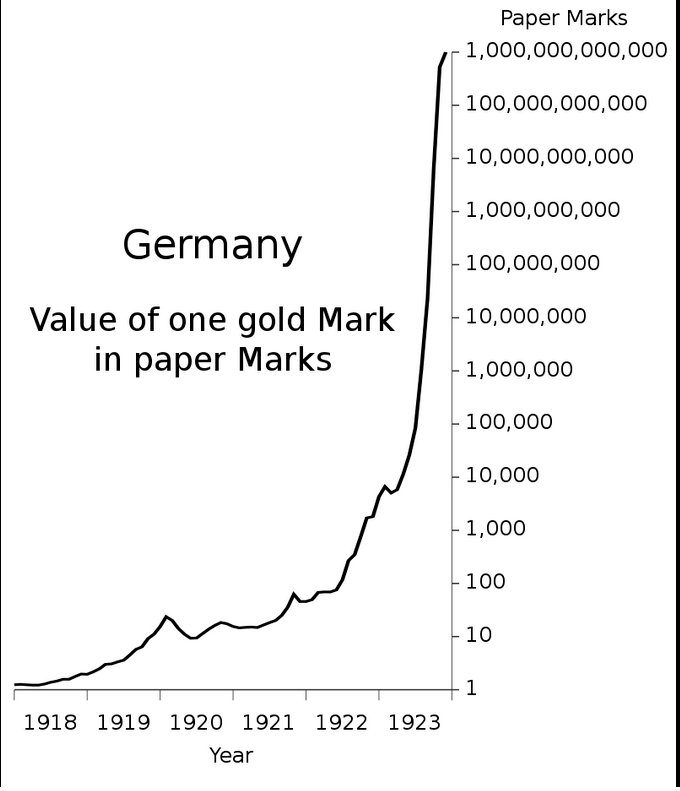

Germany's currency had already started to lose its value at the beginning of the war in 1914: In order to pay for its costs, the Reichsbank suspended the paper Mark's convertibility to gold. After having lost the war in 1918, Germany was obligated to make substantial reparation payments in "Goldmark" or hard currency.

Therefore the Reichsbank attempted to buy foreign currency on the international market with German paper money. When the first reparation installment was due on June 1 1921, the value of the German Mark had fallen from 48 paper Marks per 1 US Dollar (late 2019) to 330 paper Marks per 1 US Dollar.

Germany failed to make another agreed-upon installment payment by the end of 1922. To ensure reparation payments, French and Belgian troops occupied the Ruhr Valley, an area that was heavily industrialized, in January 1923.

A weak German government, more afraid of Communists and unemployment, but also cognizant of the public outrage about the occupation, encouraged its own workers to engage in “passive resistance” and, through the labor unions, called a general strike.

The only way for the Treasury to make good on the government's promise and pay the wages for the +/- 2 million workers and civil servants on the Ruhr Valley was to turn on the money printing presses.

As a result, Germany was soon swamped with paper money, chasing a limited supply of goods.

result, Germany was soon swamped with paper money, chasing a limited supply of goods.

Moreover, as money started to lose its value, people started to buy anything they could, especially, if they could barter with it. Speculation as well as hoarding of food and goods became rampant, initiating a vicious cycle: Germany's economy slid from inflation to hyperinflation.

(Not coincidentally, Hitler's failed "Beer Hall Putsch" in Munich occurred November 8/9, 1923 at the peak of the inflation and national misery.)

The Wiki chart left shows how German's paper currency inflation started slowly after 1918, accelerated during 1921/22, then really took off after the occupation of the Ruhr Valley in January 1923.

(You can read more about the German Hyperinflation in this Wiki entry, and in this PBS essay, or specifically about the Ruhr Occupation.)

The US Inflation Experience since 2002

Back to the US: While much has been written about the Federal Reserve also turning on “the printing presses” especially after the 2008 Great Recession, the Bureau of Labor Statistics chart above shows that inflation in the US did not really become an issue again until the Covid Pandemic in 2020.

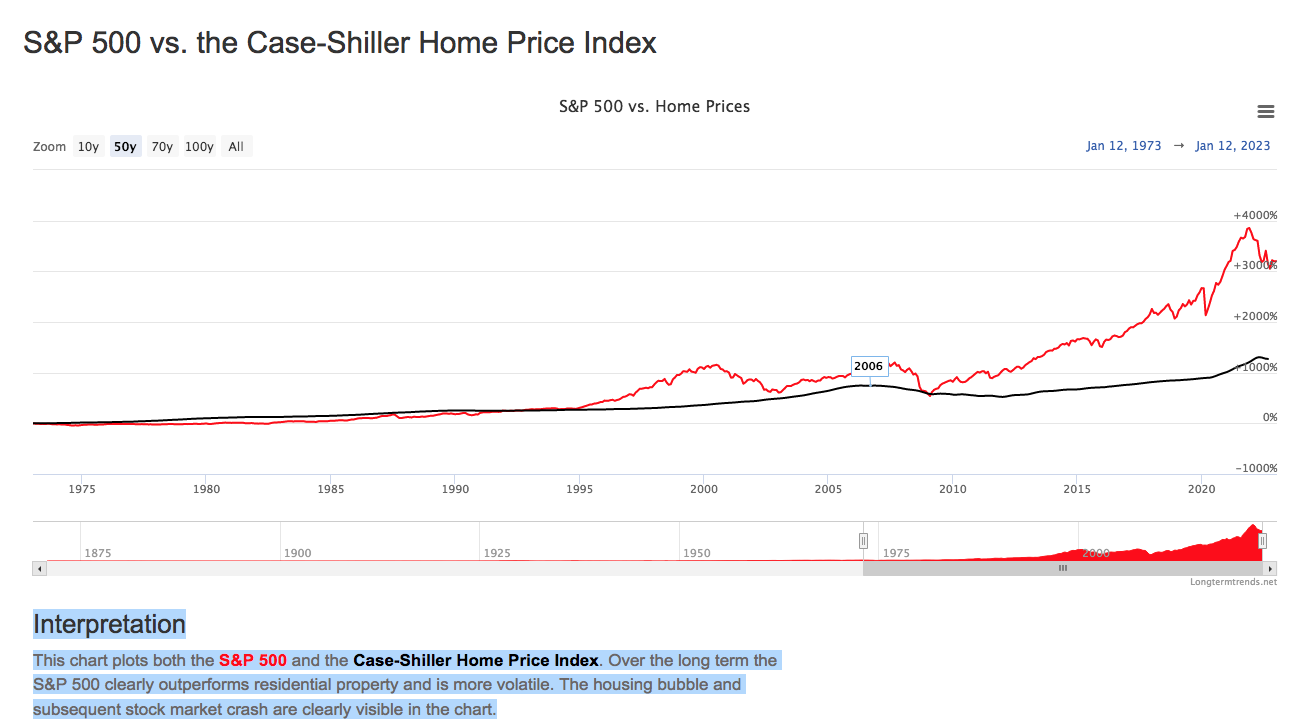

The stock market (even more than real estate prices) clearly benefited from the “easy money” after 2008. The chart below shows the changes in both the S&P 500 and the Case-Shiller Home Price Index over the last 50 years.

Courtesy of Longtermtrends.net (https://www.longtermtrends.net/stocks-to-real-estate-ratio/)

There are many explanations why the US did not experience more of a currency inflation that many had predicted. But this would be the topic of another post.

Our Hyperinflation Stamp collection

Here are some images of our family “heirloom”, a stamp album titled:

“Eine Sammlung von Viererblocks aus der Zeit der Deutschen Inflation”

(A collection of blocks of four from the time of the German inflation)

The stamp album starts off with what is likely the highest denomination of any stamp in history:

The stamp album starts off with what is likely the highest denomination of any stamp in history:

A block of four (4) stamps, each with a 50 Milliarden Mark “value”.

It was issued in November 1923, shortly before the end of the German hyperinflation.

(Also note, as explained below: 1 German "Milliarde" = 1 US Billion!)

Even as stamp values started to increase they still showed German landmarks, or original designs, e.g. German workers, etc.

But soon stamps lost any originality and their values were changed by simply overprinting.

And the values started to increase ever more rapidly, until by the end of 1923 we had reached the Milliarden (billions) denomination.

Billions vs Milliarden

By November 1923, one US Dollar was worth 4,210,500,000,000 German paper Marks. If you have trouble figuring what to call this number, you are not alone.

English speakers would call it “4 trillions and 210.5 billions”, while German speakers would say “4 Billion and 210.5 Milliarden”.

It is confusing that the English “billion” is the same as the German “Milliarde”, and that the English “trillion” is the same as the German “Billion”.

The English “billion” is:

in French: “milliard”

in Italian: “miliardo”

in Spanish: “mil millones”.

So, talking about "inflation" with our young families has been interesting, both as a way of understanding the present economy, and looking at some family history using fascinating family documents.

How did the German Hyperinflation end?

The Wiki entry Hyperinflation in the Weimar Republic, mentioned above, describes the end quite well.

Key was the introduction of a new currency, the “Rentenmark”, whose value was backed by bonds that were indexed to the price of gold.

This monetary reform took place towards the end of 1923. By August 1924 the new monetary law allowed the exchange of a 1-trillion paper mark for one (1) Rentenmark, or one (1) “Reichsmark”.

More complicated were the laws and rules that determined how creditors were to be compensated for the catastrophic reduction in the value of debts. This included mortgages, bonds and other debt instruments that were reinstated at various rates.

It led to many corporate bankruptcies, court challenges, negotiations with many stake holders, etc., but in the end the government's actions proved successful.

The ills of hyperinflation are still part Germany's national memory. They also explain Germany's insistence on fiscal prudence and restraint.

Bio: Peter Rettig is the co-founder of Gamesforlanguage.com. He's a lifelong language learner, growing up in Austria, Germany, and Switzerland. You can follow him on Facebook, Twitter and Instagram, and leave any comments with contact.